Francisca

Francisca Gold Property

Orestone holds an option to earn up to an 85% interest in the Francisca Gold Property under very reasonable terms. Francisca is a robust gold system discovered during a period of historically very low gold prices with no meaningful work conducted for almost 20 years. Based on our compilation of historic exploration data and recent Orestone mapping and sampling work we view the Francisca property as an excellent opportunity to outline a bulk tonnage oxide gold deposit. Orestone’s goal then is to define an oxide gold deposit that can be mined by open pit and would be amenable to low-cost heap leach gold recovery methods.

Location and Access

The Francisca gold property is located in the central part of Salta province on the eastern flank of the Puna area in Northern Argentina, an area that has excellent infrastructure and is host to numerous large-scale copper, gold, silver and lithium projects that are being developed.

Access to the project is by road, taking paved Highway 51 from Salta City, the capital of Salta Province to Las Cuevas and from there, secondary gravel roads provide good access to the project area which is approximately 80 kilometres northwest of the city of Salta. The terrane has moderate relief with rounded mountains ranging in elevation from 3300 to 3650 metres and wide valleys with sparse vegetation. Exploration can be conducted year-round.

Geology and Mineralization

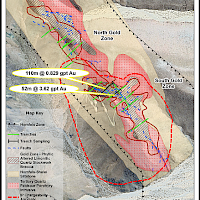

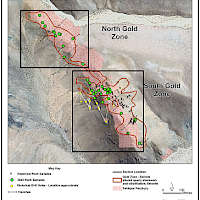

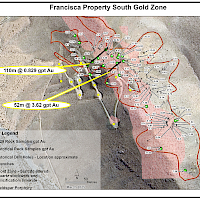

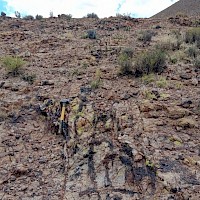

Geologic mapping has outlined an oxide gold stock-work mineralized trend along a northwest strike length of 1100 metres outcropping on the crest of a moderate relief hill. Two gold zones have been outlined to date within the trend. The surface expression of the North and South zones each measures 400 to 500 metres in strike length with widths varying from 50-100 metres. The zones are surrounded by a 500 to 1000 metre wide, area of strongly hornfels altered sediments and underlain by a large IP changeability anomaly indicating potential for a larger mineralized intrusive body at depth. The oxide gold quartz limonite stockwork trend is associated with quartz feldspar porphyry intrusive dykes and intense sericite alteration along NW trending faults.

Eighteen surface trenches at 50 to 100 metre spacings have initially outlined the zones with 11 trenches encountering significant gold and silver values. Mansfield Minerals discovered the zones in 1996 based on 300 initial grab samples from the exposed gold zones averaging 0.958 g/t gold. Mansfield then conducted detailed geological and structural mapping, trenching and detailed sampling in the period 1996-1999. Cascadero Copper later resampled portions of the trenches and drilled thirteen core drill holes in 2006 to depths of 30 to 100 metres. Drilling however was poorly oriented with a northerly strike and did not adequately test the targeted gold zones.

High grade intervals of gold are noted in historic summary reports and on trench maps over widths of 3 to 14 metres with grades from 1 to 109 g/t gold. Summaries of trenching data across the South zone are noted to have gold assay intervals of 52 metres grading 3.65 g/t gold with 17.88 g/t silver in trench TZ1 and 110 metres grading 0.82 g/t gold with 7.33 g/t silver in trench TZ2. The mineralization in both trenches remains open, indicating the potential for expansion. Mansfield noted that the high-grade intervals are hosted within a broad zone of lower grade material but only the higher-grade zones were described.

Orestone does not have the detailed assay data of the trenches or drilling as only summary data and maps of the higher-grade intervals encountered are available. Additionally, the gold assay values in the trenches are non-43-101 compliant due to their historic nature. However, the detailed geological mapping and exploration sampling programs were done by competent professional geologists and indicate the presence of a significant disseminated gold stock-work system that is only poorly tested by core drilling.

The host rocks for the mineralized zone is the Pumcoviscana sequence of greywackes and conglomerates of Upper Precambian age. This sequence is intruded by granitic to granodioritic intrusives of Devonian Age. This younger sequence is overlain by volcanic units of Cretaceous age that have been intruded by small, Tertiary stocks of dioritic to dacitic composition. Hornfels and phyllic alteration halos are associated with larger Paleozoic intrusions.

Terms of the Option Agreement

Orestone Mining Corp, through its Argentinean subsidiary, has signed an Option Agreement with two arms-length Argentinian vendors to earn up to an eighty five percent (85%) interest in the Francisca property, a seven square kilometer (700 hectares) mining concession for cash payments and exploration expenditures totaling US$4,200,000 over seven years. After reaching certain milestones, Orestone and the vendors will form a jointly owned company in which if any individual shareholder’s interest is diluted to 5%, its interest will be converted to a one percent (1%) net smelter return royalty (the NSR”). Orestone will have the right to purchase 50% of any NSR granted (0.50%) for a sum of US$1,000,000 within five years from the granting of the corresponding NSR.

Cash payment and exploration expenditure schedule:

Date for Completion and Time Period

Cash Payment

Expenditures

After Due Diligence period 15 days

US$20,000

Nil

August 4, 2025 6 months

US$20,000

Nil

February 4, 2026 1st Anniversary

US$40,000

US$100,000

February 4, 2027 2nd Anniversary

US$40,000

US$150,000

February 4, 2028 3rd Anniversary

US$90,000

US$250,000

February 4, 2029 4th Anniversary

US$150,000

US$500,000

February 4, 2030 5th Anniversary

US$840,000

US$1,000,000

February 4, 2032 7th Anniversary

US$1,000,000

TOTAL

US$2,200,000

US$2,000,000